Good Lioness helps investors achieve their investment goals:

it acts as the GPS for investment decisions

Good Lioness provides investment choices that are appropriately tailored to investors’ goals. It utilises:

* Investors’ preferences and risk profiles, based on:

* Individual circumstances

* Risk Tolerance

* Risk Preferences

* Expected Investment Horizons

* Characteristics of the potential investments (especially how their returns behave compared to the market)

* How potential investments behave with each other (especially how their returns move together)

The Problem

Most of us rely on some sort of navigation tool or app to guide us to our desired destination. Imagine if the compass in this tool was slightly mis-calibrated by a few degrees:

It probably would not matter too much if you are travelling a short distance. However, imagine where you might end up if you are driving for weeks. It might take a while to get back to your original destination when you get to the end of the journey and discover the error. What about if you are driving for decades to reach your destination?

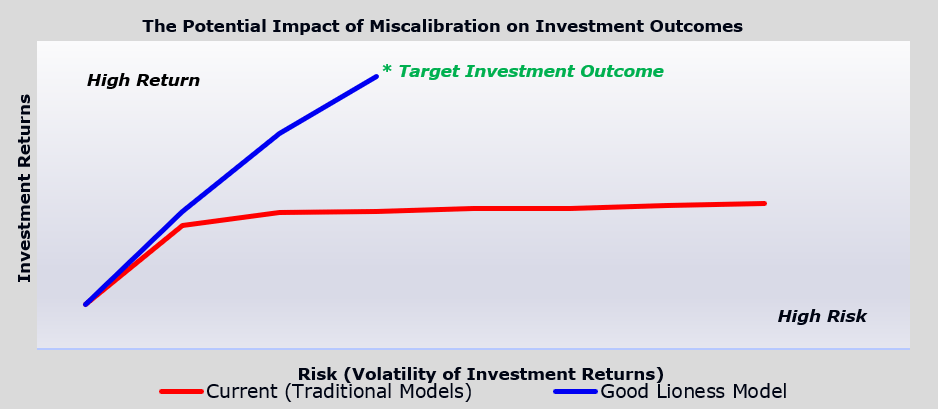

That is what we all face with long term investments like superannuation, because current investment tools and theory are a few degrees out. By the time we retire, our portfolio is not where we expected it to be, and it is too late to do anything about the error, which has been compounded over the decades, taking us off course.

Most people assume this is just due to market movements, and accept this uncertainty and lack of transparency as inevitable.

Conventional investment theory uses a one period model in a multi-period context. This causes a mathematical bias, introducing errors into portfolio optimisation choices made by investment managers. As a result, investors may not achieve their expected investment performance. The issue impacts both short term and long term investments, but the impact is magnified exponentially over time, potentially adversely affecting long term investments – e.g. superannuation.

Since this affects most investment models that are currently in use, this impacts most investments and most investors. Since most adults of working age or older hold superannuation or pension assets or annuities, this issue affects most adults. It also affects institutional investors.

Most people do not have the time, or knowledge to manage their super, so they rely on investment managers. However, in the current environment where trust in the investment industry has been significantly eroded, markets have entered a period of extreme volatility, and the global population faces extreme uncertainty about economic futures; the lack of transparency and control over superannuation performance increases financial stress.

Our Solution

This gives investors the ability to both remove the bias affecting their investment choices, and tailor their portfolio choices. It substantially reduces uncertainty, simultaneously providing transparency and control.

It has been validated using investment portfolios in 6 different global equity markets using data spanning over 28 years.

By removing the error caused by the bias introduced by conventional investment theory, investment portfolios are more likely to stay on track; giving investors more confidence that their investments can provide the performance that they are expecting when they make the investment.

For retail investors, this can reduce the stress and worry about being poor in retirement.